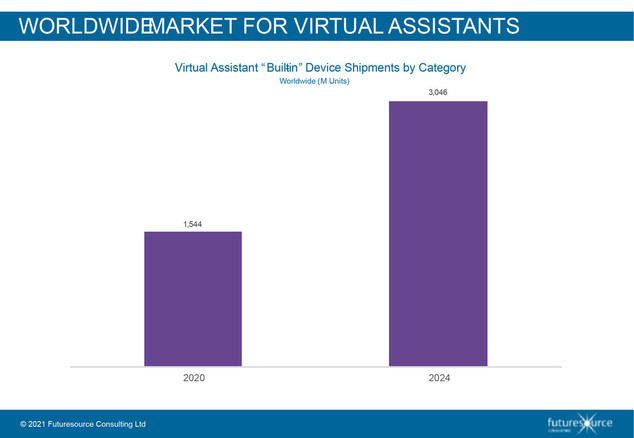

The global market for virtual assistants (VAs) continues to exhibit robust performance, propelled by enhancements in the underlying technologies along with increasing penetration across Consumer Electronics. According to the latest research from Futuresource Consulting, shipments of products with built-in voice assistant technology will double to 3.0 billion units in 2024, representing a CAGR of 19% across the forecast period. The impact of COVID-19 dampened VA shipments throughout 2020; however, the effect of lockdowns on consumer purchasing was less pronounced than anticipated, and 2020 saw a 9% increase in shipment volumes overall.

Apple, Google and Baidu emerged as the top three VA platform vendors by unit shipments in 2020. Apple’s Siri holds 25% share worldwide, reflecting strong sales in Apple iPhone, iPad and Airpods; the newly announced AirPods Max will expand Siri’s opportunity further in 2021. Google Assistant holds 22% share, primarily due to its integration in Android smartphones and tablets, but also now illustrating moderate growth in the wearables category. Baidu hold 14% market share overall, driven by its success in smart speakers and smartphones. The company made moves into hearables, launching XiaoduPods late in 2020; meantime, further collaboration with Huawei promises to widen their market opportunity in 2021.

“Voice control has established itself as an essential feature across consumer electronics,” says Simon Forrest, Principal Technology Analyst at Futuresource Consulting. “The audio processing aspects of virtual assistants have largely matured, and focus has shifted towards improving assistant competency and optimising language models. As such, innovation now lies squarely in the hands of the technology giants with knowhow in artificial intelligence.”

Although virtual assistant technology is continually improving, the gains are becoming harder to quantity and questions are being raised around the efficacy of voice interfaces. “Virtual assistants promise a frictionless way to interact with products and services, yet the industry is still several years away from perfecting ‘voice first’ interfaces and may never become truly independent of screens,” explains Forrest. “Virtual assistants must deliver accurate responses each and every time, otherwise consumer adoption diminishes. So, platform vendors are working to enhance the contextual awareness of their VAs and develop AI capable of surfacing precisely the right results.” VA platform vendors offer tools to assist the evaluation of natural language processing models. While these cannot solve all analytical issues, developers are employing these tools to quantify whether amendments to their AI models actually improve the results, whilst the opportunity for regression testing helps ensure that modifications to interaction models do not degrade the experience.

Platform vendors are moving swiftly to utilise neural network accelerators (NNAs) to place many elements of voice engines at the edge, on devices themselves, to reduce latency and increase privacy. Prime examples of this include the Honghu AI chip jointly developed by Huawei and Baidu, and Amazon’s AZ1 Neural Edge processor, allowing voice algorithms to execute on the device itself, starting with an all-neural speech recognition model that handles requests locally. Moreover, vendors are creating lightweight VA solutions that can run even on small microprocessors, extending the opportunity to place voice into battery-operated devices. “Virtual Assistants are developing beyond simple command and control mechanisms, transforming into platforms with rudimentary conversational ability and intelligent anticipation,” advises Forrest. “In 2021, we expect VA platforms will become capable of participating in conversations and deliver new monetisation opportunities for service providers beyond harvesting data on usage behaviours.”

The market is now changing, with product designers now considering whether the optimum approach might be in using domain-specific assistants. “Domain-specific assistants promise to improve command-based interaction, since it’s easier to map the range of user intents to a limited subset of outcomes, whilst also expanding the number of ways users can make their request,” explains Forrest. Conversely, cloud-based virtual assistants are steadily becoming better at extracting complex intent from voice queries, since they harness the dual benefits of flexible machine learning coupled with massive knowledge banks.

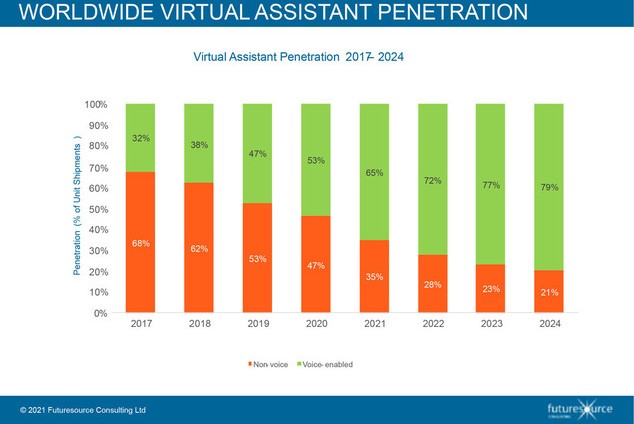

The trend of integrating voice into devices continues. Futuresource predicts that four out of every five consumer electronics products sold will exhibit some form of virtual assistant capability by 2024.