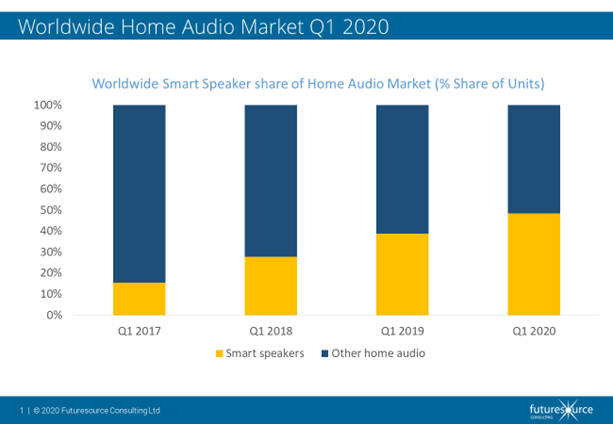

14 May 2020 – Smart speakers are driving the home audio market forward, leading to Amazon and Google taking top spots in the brand share rankings according to newly released data from Futuresource Consulting’s Worldwide Home Audio tracker. That is despite the supply chain challenges and disruption caused by COVID-19, which has applied downward pressure on the overall home audio market, resulting in devices without a built-in voice assistant declining more than 20% year-on-year.

Smart Speaker Segment Standing Strong

“Amazon and Google’s growth in the home audio market shows that smart speakers continue to stand strong against a changing tide,” says Guy Hammett, Market Analyst at Futuresource Consulting, “and their consumer appeal will help the category continue to resist the undertow. There is no doubt that smart speakers have a lot going for them. Before COVID-19 restrictions, these products were already regularly bought online, so they have suffered less from physical retail lockdowns. They are specifically designed for in-home use too. Plus, tech giants with deep pockets continue to subsidise their lynchpin products in times of economic uncertainty. Smart displays are also following suit, growing 373% in 2019 and enjoying a particularly healthy Q1, with video calling a key use case.”

Conversely, Bluetooth speakers have hit a wall in Q1, declining more than 25% when compared with Q1 2019. Futuresource research shows that outdoor usage continues to be a key purchase trigger for these devices, with the lockdown in most major economies pushing those who are still buying speakers towards Wi-Fi speakers instead.

Video Content Great News for Soundbars

Futuresource video content research shows that people are consuming more streaming media than ever before. Major launch announcements and acquisitions from NBCUniversal’s Peacock and Warner Media’s HBO Max have joined AppleTV+, Disney+, Netflix, Amazon and Hulu to bring even more choice to consumers. This has prompted many consumers to explore ways to improve their home entertainment experience, and they have turned to soundbars to augment their TV sound. As a result, soundbars have significantly outperformed non-smart wireless speakers, despite a slight year-on-year decline.

“Looking to the brands, it’s the tech giants who have strong interests in the smart speaker market that have captured the greatest share of Q1 wallet,” says Hammett. “Amazon, Google, Baidu, Alibaba, and Xiaomi have all enjoyed a strong quarter relative to the overall market. Beyond smart speakers, many of the major audio brands saw double figure year-on-year declines, although their shipments still held up better than some of the smaller local or regional players.”

The new Futuresource report shows that Western Europe had the toughest market conditions in Q1, with COVID-19 impacting the market from late February in some countries. The US saw less of an impact, with sales in the region holding up well until mid-March. Demand in China remained surprisingly strong throughout the quarter.

Growth Getting Back on Track

“Beyond Q1, we’re seeing some early indications of market revival,” says Hammett. “Our preliminary findings from April are showing that US demand has bounced back strongly. Western Europe has also seen an uptick, but it’s not as pronounced as in the US, while we expect full year 2020 demand in China to be almost as high as it would have been if COVID-19 had not hit.”