08 Apr 2020 – Streaming subscriptions remain the number one growth driver in the global music market, accounting for more than 70% of spend on music last year. Yet, as measures to halt the spread of COVID-19 begin to reshape the lives of consumers, music streaming is experiencing a temporary drop in consumption.

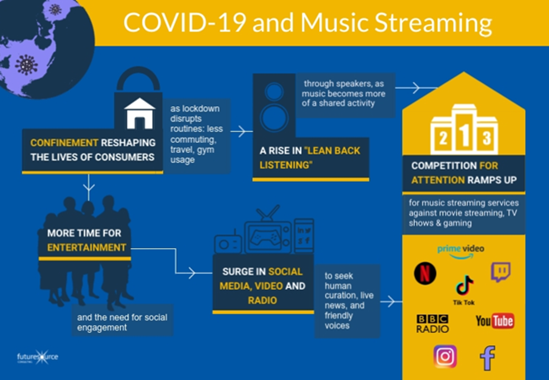

“We may have expected to see an uptake in the use of streaming music services, as people become confined in their homes,” says Alexandre Jornod, Market Analyst at Futuresource Consulting. “However, that’s not the case, with early indicators showing the contrary. Streaming consumption in countries in lockdown appeared to have dropped between 15% to 20%. This is linked to consumers adjusting to new confinement rules, which have removed key music listening situations like the daily commute, as well as office and gym time.”

Music a Shared Pastime

With families spending time at home together, music consumption is also becoming more of a shared activity. Whereas before the outbreak, people were using separate accounts to play different music throughout the day, smart speakers are now likely to be increasingly used and with a single account used to play music in the household. In the same way, radio has seen an increase in consumption, as listeners seek human curation, live news, friendly voices and companionship. There is also tough competition from gaming in addition to movie and TV show streaming. These activities require a higher level of attention and tend to be favoured when some extra time is freed up as a result of routines being interrupted.

New Routines, New Opportunities

“Once consumers become accustomed to the situation and establish new routines, we expect streaming music to get back to levels similar to before the crisis, with premium subscriber uptake to show renewed growth, particularly in H2, largely compensating for any slowdown in H1,” says Jornod. “Home listening will dominate, with a shift in the music types and genres as consumers seek out lean-back mood playlists as opposed to searching for specific songs or artists.”

Spotify and Apple Flying High

Spotify and Apple continued to lead the way last year, accounting for over 60% of global subscriptions between them, a leadership trend that will continue. Spotify retained the global number one position, though Apple captured the top spot in the USA. Amazon Music also experienced strong growth with its multiple streaming plans catering to a wide audience, although its subscriptions are closely linked to Echo smart speaker geographies, which skew heavily towards the USA and UK. YouTube Music, despite lagging behind the competition in terms of subscribers due to its late re-entry to market, has the potential to become a key player thanks to its established YouTube audience. Smaller players like Deezer, Tidal and Napster are focusing instead on strategies such as targeting local markets, serving niche audiences or B2B operations.

“Streaming music subscriptions also benefit from markets where physical media has been historically strong and they are now transitioning to streaming,” says Jornod. “The likes of Germany, Japan and France are experiencing accelerating adoption, whereas maturing markets in North America and Europe are seeing a focus on value-added features as a differentiator. Watch out for a rise in podcasts beginning to exert its influence, as well as enhanced listening experiences such as Hi-Res audio, Dolby Atmos Music and Sony 360 Reality Audio.”