The worldwide AV headphones market is on track to ship 284 million units this year, equivalent to growth of 9% over 2012, with revenues forecast to reach $8.2 billion according to new research from Futuresource Consulting

“The headphones market is highly fragmented and increasingly competitive, with new brands continuing to emerge across all price categories,” says Rasika Iyer, Research Analyst at Futuresource. “Traditional headphones brands Philips, Sony, JVC, Sennheiser and Skullcandy combined accounted for 45% of global headphones shipments in 2012 and in terms of value, Beats by Dr. Dre has captured 23% of global revenues.“

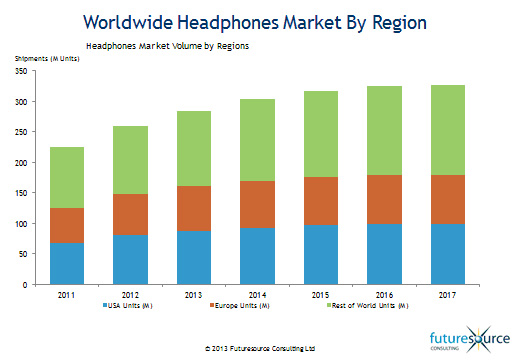

Volume growth is anticipated throughout the forecast period, with sales flattening by 2017, as the market saturates at one set of headphones per 6.6 audio devices in use, including smartphones, tablets and home audio systems. Headphones will be shared among a growing number of devices, while many consumers will rely on headphones bundled with devices.

However, the worldwide retail value is forecast to grow 5% CAGR from 2013 to 2017, due to further increases in the average selling price, with the demand for premium over-ear headphones expected to continue growing more quickly than the market.

The over-ear category accounted for 44% of worldwide revenues in 2012 and this share is expected to grow to 52% by 2017. Premium fashion brands such as Beats by Dr. Dre have revolutionised the over-ear category from being a predominantly home audio accessory, to also being a premium portable AV accessory.

While in-ear headphones continue to dominate the headphones market in volumes, the more expensive on-ear and over-ear segments, are growing in share, especially in USA and Europe.

“Headphones with microphones were an emerging trend in 2012 and accounted for 17% of worldwide headphones shipments,” says Iyer. “This trend is expected to continue and we estimate that in 2017 41% of shipments will be equipped with microphones. Demand for the feature is fuelled by smartphones, business-users and commuters, though the feature is less popular in some countries such as Germany, where feature convergence can be perceived as compromised quality.”

In 2012 the largest share of channel sales was for CE retailers, which accounted for 38% of the market. Telecoms channels are expected to grow from 2013 onwards as more vendors use mobile specialists to distribute AV headphones. Meanwhile emerging markets in certain countries in APAC – such as China and India – and in Latin America will grow more quickly than the overall market, which is closely linked to device adoption growth.