For the first half of 2013, sales of interactive whiteboards and interactive flat panel displays in the education and corporate sectors were up 20%, according to the latest quarterly research from Futuresource Consulting. This is despite the increasing presence of personal tablet devices in the education sector, which continue to gain a foothold. The following data provides key highlights from the market report.

Asia: China dominates with 40% of all sales, but will decline in 2014

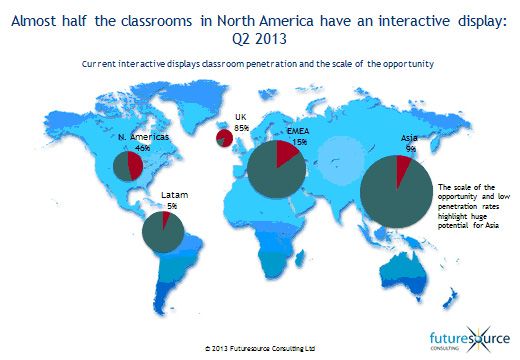

Asia is, by far, the largest world region with over half of all sales. This was primarily due to China, which retained its position as the largest world country market, with 40% of the global market and 77% of the region’s sales.

“By the end of 2013, 37% of classrooms in China will have an interactive display, which means it’s fast approaching the drop zone,” says Colin Messenger, senior market analyst at Futuresource. “When the UK and USA reached this level of penetration the volumes started to decline, and the same is likely to happen here; our forecasts show that by 2017 China will represent 20% of world sales, from its current position of 40%.

“India also experienced a substantial quarter, with more than a 50% uplift in sales so far this year. Across Asia, we expect large-scale education tenders to continue throughout the year.”

USA: market continues to fall

“In the USA, Q2 volumes fell to 15% below 2012 levels and the education market will continue to decrease over the next few years,” says Messenger. “By the end of this year over half of K-12 classrooms will have an interactive display and the early models sold into the market are not yet ready for replacement. The growth of tablet adoption continues unabated – Apple recently announced a large deal with the Los Angeles Unified School District – consequently not only hitting the displays budgets but also offering a must-have alternative.”

EMEA: Strong growth expected next year

EMEA experienced a slow start to the year after substantial growth in 2012. However, with large expectations from the FATIH tender in Turkey, 2014 is expected to be by far the highest performing year on record.

UK: interactive flat panels account for 25% of sales in Q2

Interactive flat panel displays are starting to take market share from interactive whiteboards in the UK and some of the first replacement boards are being purchased, with schools inclined to buy the same brands again. Futuresource forecasts show the market value will rise 10% per year with the increased adoption of interactive flat panels in schools.

The construction of new free schools in the UK – also known as partnership or charter schools in other countries – continues to present an opportunity. In the third wave 102 are due to open in September 2013, bringing the total to 181 with more applications submitted to 2015 and beyond.

The Global Perspective

Futuresource forecasts show that the total display technologies market of interactive whiteboards, interactive flat panels and interactive projectors will reach 1.05 million devices by 2017. However, the adoption rates of the three products are very different by country and even by region (Futuresource has compared all three technologies in 66 countries).

“In 2012, over three million tablets were purchased by schools across the globe and this has definitely contributed to increased competition for education budgets,” says Messenger. “However, the scale of the corporate space presents a number of alternative opportunities. With over 67 million meeting rooms worldwide, this segment of the corporate market alone is twice the scale of school classrooms. As a result, moving forward we see the corporate market as the fastest growing sector, increasing to 23% by 2017, with the growth coming from more developed markets like the USA, UK, Germany and Sweden.”