The USA consumer photo-merchandise market grew 18% to over $1.5 billion in 2012 and positive growth is expected to continue with the market developing to over $1.9 billion by 2015, according to the new photo-merchandise market report from Futuresource Consulting.

“This growth is significant for the industry, particularly as the traditional photo prints market continues to decline,” says Matt Marshall, Head of Print & Imaging, Futuresource Consulting. “Photo merchandise will play a pivotal role in driving revenues for many of the players in this industry.”

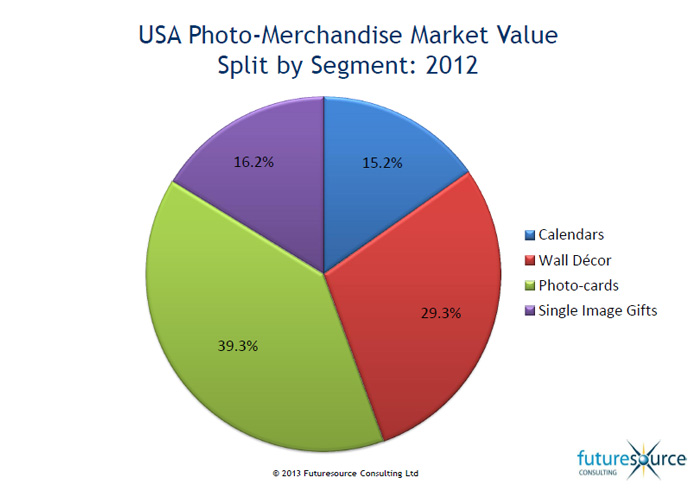

Photo cards continue to dominate the US photo merchandise sector overall, accounting for nearly 40% of market value in 2012. Multiple packs of cards, both single sheet and folded are popular for christenings, weddings and seasonal events in the USA, with Shutterfly/Tiny Prints and Snapfish as the key resellers in this area, along with the retailers Walmart and Walgreens.

In terms of growth, the canvas prints (and other substrates) segment, leads the way and experienced over 60% growth in value in 2012.

The single image gift market reached $250 million in 2012, a growth of 20%, with further healthy growth expected throughout the forecast period. During 2012, iPhone and iPad covers were a particular growth sector in this segment of the market.

The photo calendar market in the USA is anticipated to continue to grow, though calendars, by their very nature, remain a seasonal product with the majority of sales occurring between November and January.

Photo poster sales are expected to continue to grow during 2013 according to Futuresource forecasts, experiencing a 13% increase on 2012. Many retailers are able to offer poster production in-store, which has resulted in an average price of less than $10 in 2012, further bolstering this market.

Moving forward, the outlook for the US photo merchandise market is favourable, with positive but diminishing volume growth through to 2016 and the market value peaking in 2015.