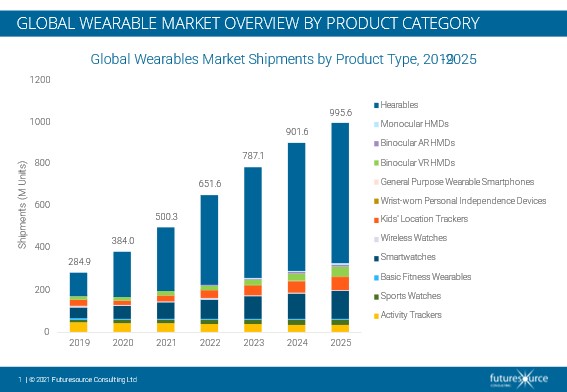

The global wearables market continues to thrive, sidestepping any negative fallout generated by the COVID-19 pandemic, and achieving 35% volume growth in 2020. That’s according to a newly-released market report from Futuresource Consulting.

“2020 has been another milestone year for wearables,” says Stephen Mears, Market Analyst, Futuresource Consulting. “Widespread lockdowns, enforced social distancing and an increasing awareness of health, fitness and wellbeing have played to the strengths of wearables. Combine that with the closure of gyms and leisure centres and you have perfect conditions for stimulating demand. Our research shows that consumers have been seeking out and spending on technologies that help them monitor biometric indicators and support health and fitness goals, regardless of any economic uncertainties.”

Hearables lead the way

In volume terms, hearables is the hero, with True Wireless proving itself as the form factor of choice for a broad base of consumers.

“It’s a strangely divergent situation,” says Mears. “From a sensor perspective, the ear is better than the wrist for a wide range of biometric measurements. Whether that’s heart rate, blood pressure or SpO2 readings, the ear is the clear winner. However, the majority of hearable consumers purchase these devices for the audio function. Consumers who are interested in biometric tracking still tend to prefer the wrist form factor, in part due to the presence of a screen. Despite this, the ear wins out in sales terms.”

Smartwatch is the One to Watch

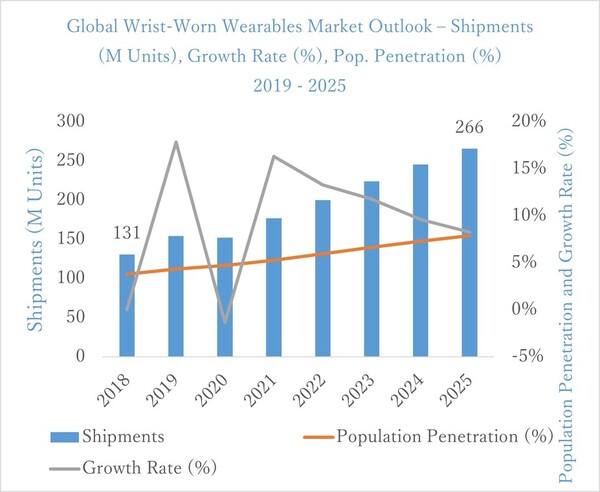

Focusing on wrist-worn wearables, smartwatches continue to dominate. They accounted for 40% of all wrist-worn shipments in 2020, and Futuresource expects this to increase to 50% by 2025.

Apple Continues to Dominate

“Apple still leads the way,” says Mears, “overshadowing the competition with a close-to-two-thirds share of the smartwatch market and an overall market share of 33% across the entire wearables segment. The technology leviathan’s power to influence the consumer is so strong that when you combine its three closest rivals Xiaomi, Huawei and Samsung, they can only achieve two thirds of Apple’s wearables market share.”

Yet Samsung’s return to the WearOS portfolio, announced in May at Google I/O 2021, has the potential to redefine the competitive landscape. Futuresource expects the unification of Samsung’s Tizen OS with WearOS to give rise to a significant improvement in software, content and services across WearOS’ broad portfolio of devices. Moreover, it may well encourage other vendors to join the ecosystem. As with smartphones, the smartwatch market is now a key frontier in the ongoing OS competition between Google and Apple.

The Only Way is Up

Futuresource expects industry momentum to continue out to 2025. This will result in a wearables market size of almost one billion units by the end of the forecast period, with a global installed base of more than two billion devices.