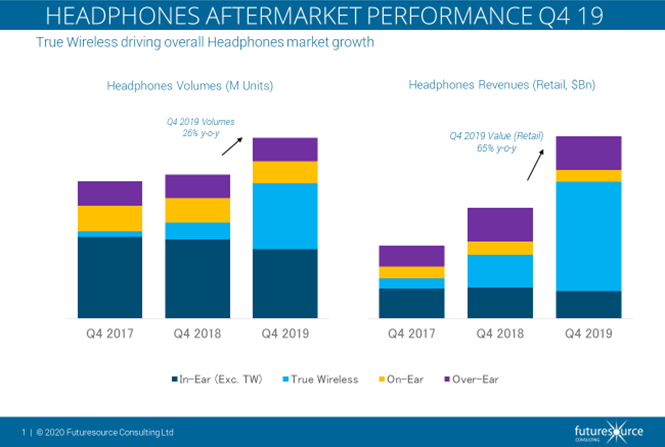

11 Mar 2020 – The global headphones market continues to capture consumer attention and attract spend, with year-on-year shipment growth exceeding 25% in Q4 2019, according to the latest quarterly tracker from Futuresource Consulting.

“Not only are more consumers buying aftermarket headphones, they are choosing premium models,” says Adriana Blanco, Senior Market Analyst at Futuresource Consulting. “True wireless topped the features list in Q4, accounting for more than a third of the 162.7 million shipments. Apple AirPods Pro was one of the standout performers, despite news of undersupply in most markets. And although Apple remained the true wireless leader, competing brands, particularly Xiaomi and Samsung, are beginning to gain more momentum and chew into Apple’s market share.”

Strong Shipment Growth Eclipsed by Revenues

Even though shipments performed exceptionally well in the quarter, this was eclipsed by revenues, which achieved more than twice that growth. Increasing by 65% year-on-year, this translates to a total spend of $14.1 billion worldwide in Q4.

Beyond true wireless, all other form-factors saw volumes retreat year-on-year. After six quarters of consecutive growth, over-ear prices declined slightly, reflecting multiple offers during November and December, stemming from Black Friday, Chinese Singles Day and Christmas.

“Over-ear typically commands higher prices, as it incorporates many advanced features,” says Blanco. “Sony, Beats and Bose are leading the field, though rumours persist that Apple may be working on a premium over-ear model. It’s a tricky call for Apple, as they could cannibalise their own Beats product offering.”

Average Retail Prices on the Up

Average retail price also continues to inflate, driven by growth in true wireless models in the over $200 segment. This is being propelled forward by the success of AirPods Pro, which was also responsible for pushing noise cancelling penetration rates into double digits during the quarter. Apple maintained its lead position in the quarter in both volume and value terms, followed by Sony and JBL in units, whereas in value Sony also took second place and Beats third.

“Under normal circumstances, we would expect a bullish market as we move forward,” says Blanco. “With many brands showcasing noise cancelling and true wireless models at CES in January, 2020 could be a watershed year for this feature. However, the coronavirus situation is bound to impact the market both in terms of supply and demand. Our next headphones quarterly tracker will quantify Q1 2020 and this will help uncover the actual effect of Coronavirus on the headphones market.”