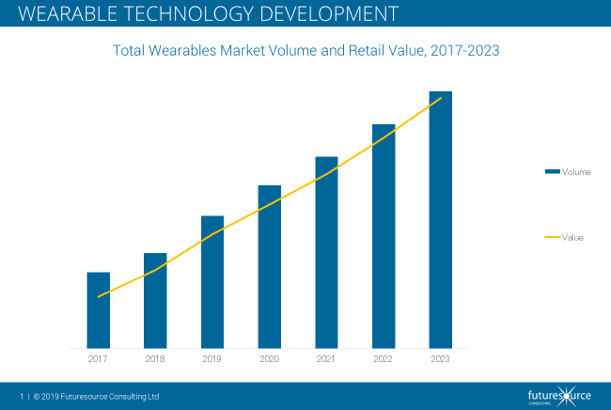

15 Nov 2019 – Wearable tech continues to gather pace, building an ecosystem of connected devices and capturing consumer attention to the tune of $108 billion by 2023, according to a new industry report from Futuresource Consulting.

“There is no doubt that wearable tech is stealing the CE show,” says Stephen Mears, Research Analyst at Futuresource Consulting. “While the wider CE market is experiencing a general plateau, wearables are in the growth zone. From a retail value of $22.5 billion in 2017, we’re forecasting nearly $50 billion for 2019, with the category powering on through to account for around 10% of all CE revenues by 2023. That’s quite an achievement.”

With an ever-growing raft of features, driven by innovation and competition, tech is moving away from the pocket and onto the wrist or into the ear. Apple is perfectly placed to exploit the wearables landscape, a journey that began five years ago with its acquisition of Beats and a move into the premium audio market. Its longer-running partnership with Nike also adds weight, although Apple’s emphasis is on building out its own ecosystem. Meanwhile, Samsung has a firm foothold in a number of key categories and is making volume gains with its wide price-point strategy, while Google’s acquisition of Fitbit suggests it is seeking to exploit the wearables and health metrics trend.

Current growth is centred upon the connected watch segments of smartwatches, wireless watches and wearable smartphones.

Kids’ watches are also an emerging category poised for global growth. The category has already established itself in China and Futuresource expects it to come to prominence in western markets very soon, particularly as telecom operators such as Verizon, T-Mobile and Vodafone are partnering with kids’ watch vendors to bring products to market.

Smartwatches will remain the dominant wearables category throughout the forecast period, with the broad and varied functionality offered by these devices key to consumer appeal. Indeed, the most successful products are those that don’t rely on a single defining use case. Multi-functionality is becoming the major driver of product success, with vendors now differentiating products on user experience and utility.

A major mid-term trend will be a geographical shift in demand to the Asia Pacific region excluding China, with Futuresource forecasting a 40% increase by 2023, to account for 20% of global share. Much of this growth will come at the expense of China’s share, which is expected to lag behind the wider APAC region.

“Moving forward, we expect feature sets to drive competition across the globe, not only between key vendors, but also between product categories themselves,” says Mears. “Fitness tracking will remain a short-term must-have for wearable devices, with fitness devices, connected watches, wrist-worn mobile phones and hearables all clamouring for consumer attention. The challenge will be to create a competitive product that propels innovation to the next level and generates new use cases.”