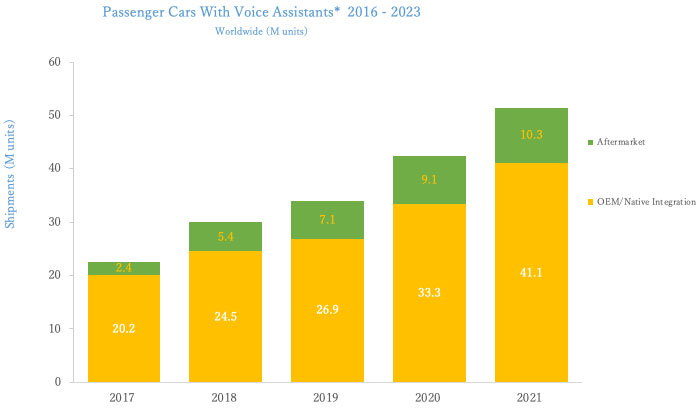

26 Sept 2019 – Voice assistants are enjoying widespread adoption within smart devices, personal electronics and speakers, but their usage in-car has garnered relatively little attention. Push-to-talk voice solutions have been integrated into cars since the 1980s, but have been typically based on onboard processing with a relatively limited range of commands. However, the landscape is shifting. A new generation of connected voice assistants offering cloud processing (either hybrid or pure cloud) are now poised for rapid adoption. By 2023, almost two in every three new passenger cars will incorporate the technology, up from less than 30% last year, according to a new automotive audio

report from Futuresource Consulting.

Automotive Voice: Ready for the Next Generation

“The automotive sector is a natural home for connected voice assistants,” says Mike Fisher, Associate Director at Futuresource Consulting. “They allow simple, hands-free access to information and vehicle functions in an environment that demands attention on a larger task. Yet, with lifecycles of ten years or more, plus design cycles of two years,vehicle manufacturers have been at odds with leading-edge CE innovations. Beyond Bluetooth, in-car connectivity has traditionally been poor, limiting the practical use cases. All this is about to change, as the widespread consumer appeal of voice assistants, combined with the rise of the connected car and new technology innovation, is sowing the seeds of opportunity.”

Going forward, connected voice assistants will play a key role in the cockpit, ushering in a new range of value-added opportunities, including car service offerings, location-based services and e-commerce.

Next Generation Assistants: Developing Intelligent Interjection

Voice assistants are beginning to develop beyond simple command and control mechanisms, transforming into platforms with advanced conversational ability and intelligent anticipation. Ultimately, voice-enabled products will be able to interject in conversations and deliver new monetisation opportunities for service providers beyond harvesting data on usage behaviours. From a proactive reminder about booking the annual service at an approved service centre, to locating a suitable parking spot through a smart parking app as it enters a city, the potential use cases are widespread.

Hybrid solutions – those that combine both processing locally on chip and in the cloud – will come to the fore as technical innovation in semiconductors allow for much greater on-chip processing, leading to enhanced conversational ability. These hybrid solutions will combine the security, speed and stability of on-board processing with the near-infinite usage possibilities of cloud solutions, with low-latency, high performance 5G mobile networks likely to become the backbone for connectivity.

Full OEM Control or CE Partnership?

“As connectivity opportunities begin to grow, car manufacturers have been developing their own solutions in conjunction with white label providers, such as Nuance and Soundhound,” says Fisher. “This allows the manufacturers to maintain full control, ring-fencing their customer data and building a direct relationship with them. However, battle lines are being drawn and leading voice platform providers like Amazon, Baidu and Google are targeting and gaining some traction in the

automotive sector.”

As well as providing new service revenue opportunities, the in-car digital experience is an increasingly important part of the brand experience: do car manufacturers maintain full control, or do they allow their customers to use their favoured platforms seamlessly? The latter option entails forfeiting a significant part of the in-car experience and the valuable data that is generated alongside. Short to mid-term, a middle ground is likely, with multiple assistants set to co-exist. Car manufacturers want to maintain control over core car functions such as checking the fuel level, turning on the air conditioning and monitoring performance issues. In order to achieve this the system needs to integrate with the vehicle’s central Controller Area Network (CAN bus). As a result, this creates a deep level of system integration and affords opportunity to access detailed user data, all within a secure domain maintained by on-board vehicle control systems. Non-car-specific commands like entertainment, news, local information and traffic, can then be handed over to a second, well-established, consumer-focused assistant for processing in the cloud.

While multiple voice assistants make commercial sense for car manufacturers, the user experience must be carefully considered, and confusion must be eliminated. There are currently two main options: multiple wake words or cognitive arbitration. With wake words, voice-controlled products remain in a low-power mode until summoned by the occupants. This can feel like an unnatural method of interaction, especially when utilising multiple wake words to interact with the system. With cognitive arbitration, the car OEM branded assistant evaluates the voice command and presents it to the most relevant assistant for processing.

“Cognitive arbitration is clearly an attractive proposition for car OEMs,” says Fisher, “as it allows them primary control over the ecosystem. However, will they be able to convince consumers of the benefits of such a system when compared with their favoured voice assistant platform? The early years of CarPlay and Android Auto provide a lesson from history as many manufacturers were reluctant to integrate them initially, but now they are almost universally adopted.Toyota, one of the last big manufacturers to adopt both CarPlay and Android Auto, has finally announced Android Auto will be added to some of its 2020 ranges.”

Aftermarket Opportunities

With around one billion passenger cars in use globally, the aftermarket also provides a lucrative opportunity for CE vendors. Sales of aftermarket head units have been falling across the globe as rapid development in new car solutions piles on the pressure, but multimedia head units that utilise the phone connection for voice functions are providing a lifeline and increasing head unit ASPs. Android Auto and CarPlay are taking an increasing slice of the aftermarket, and growth is expected to continue, particularly as Google Assistant improves language support and becomes available in more

countries. Amazon and Google (and partners) have also launched accessory style products designed to offer simple voice capabilities at relatively low cost.

As cars become increasingly connected, the battle begins for control of the rapidly changing cockpit and the in-car user experience. Futuresource expects next generation voice assistants to play a key role in impacting how the competitive landscape evolves. Will a multi-assistant environment prove a satisfactory experience to users or will they navigate towards car manufacturers that offer their favoured voice assistant? Might consumer concerns around data protection,privacy and tech overreach limit the potential use cases of voice assistants?