As Google and Amazon continue to jostle to position themselves as providers of the leading smart home voice control device, Futuresource Consulting delivers its fourth timely consumer survey. This reveals in-depth insight into the key triggers and obstacles surrounding the development of this market, which has demonstrated strong double-digit growth of around 40% year-on-year between 2016-2019.

The Futuresource Consumer Smart Home study took representative households across the UK, France, Germany and the US and assessed ownership, perceptions and use of smart home and smart appliances.

“Smart speakers led the field in terms of popularity and adoption, closely followed by climate control, which has become the most common first installation – slightly ahead of security, lighting and smart monitoring devices, such as smoke detectors,” commented Filipe Oliveira, Market Analyst at Futuresource Consulting. “Climate control was more favoured by the European respondents and is typically the most common first step into the smart home implementation across all markets. It is no wonder that big tech firms such as Google and Microsoft have an interest in smart climate control,” added Oliveira.

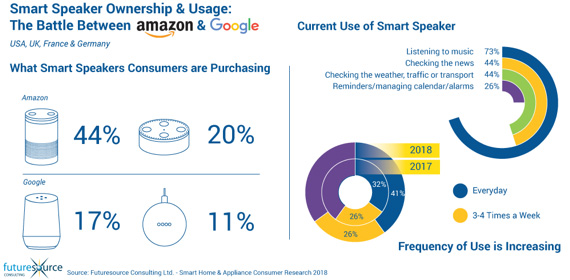

But what is happening in terms of the ‘Smart Home’ voice assistant Trojans race? According to Futuresource, Amazon is leading the land grab, especially in the USA and UK. However, it is being challenged by Google in markets like France, where the Amazon Echo has a problem with “ne parle pas Français”, hence the multilingual Google Home is getting approval in non-English speaking markets.

When it comes to awareness and interest in the usefulness of smart speakers, this “Entertaining, knowledgeable, helpful, creative, efficient and timesaving device”, as described by respondents in the survey, has an awareness rating of over 80% across all markets. However, Oliveira added, “there is much more room for growth in terms of ownership, as 42% of non-owners stated that they were intent on making a purchase very soon.”

Looking across the full gamut of smart devices discussed in the study, consumers saw more appeal in the larger smart appliances category compared to the smaller appliances. Though, coffee machines were a clear exception.

Furthermore, there was a clear interest in user cases that discussed the infotainment device category. However, the preferred device was the smart speaker with consumers stating that they had no interest in seeing it in other areas (e.g. smart fridge).